CPF Minimum Sum Increases In July 2015

Last Updated: Jun 16, 2015

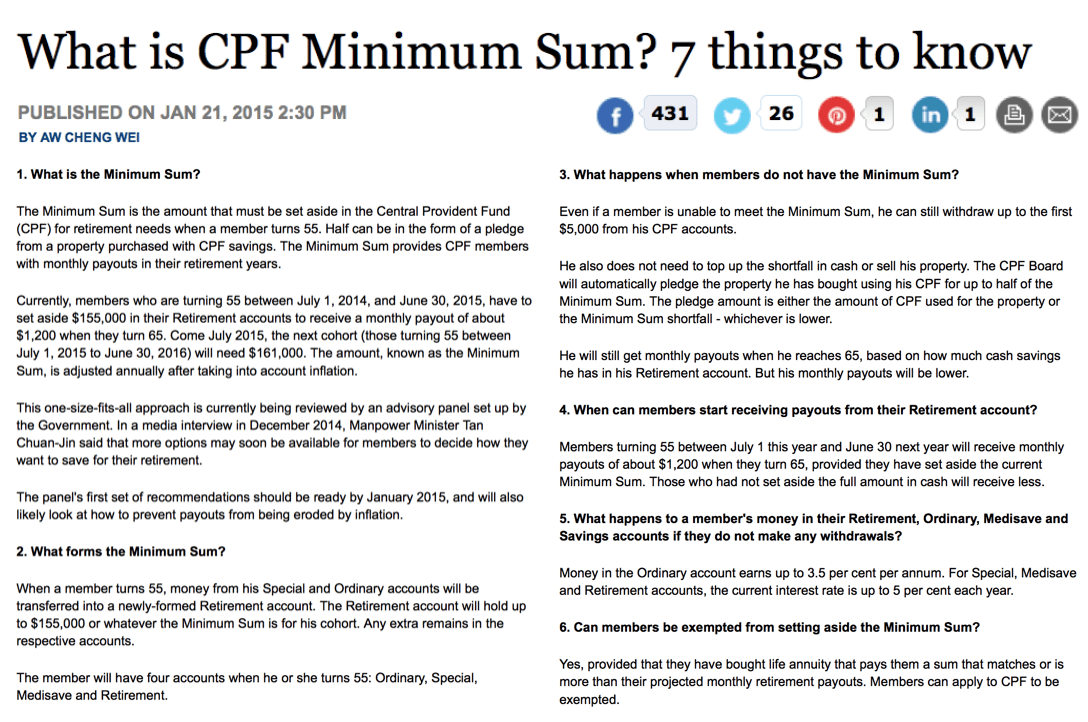

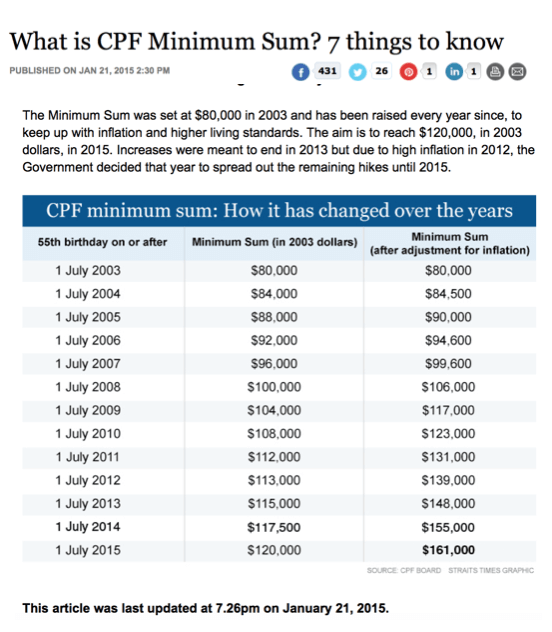

The Central Provident Fund (CPF) Minimum Sum is a sum of money to be kept by its members till age 55 for retirement purpose. Members are allowed to keep half of the minimum sum if the other half is pledged in a property funded by his / her CPF money. At age 65, members will get to enjoy a monthly payout. The current period between 1 July 2014 and 30 June 2015, the minimum sum is $155,000. However, come 1 July 2015, the minimum sum will be raised to $161,000. The gradual rise in the minimum sum is mainly to prevent the value of the payout to be eroded away by inflation when members reach 65 years old.

On the other hand, if a member already owns a current property paid utilizing CPF, be it a Housing Development Board (HDB) flat or a private condominium, and he now wishes to purchase a private property (whether a resale condo or a new condo launch), he definitely has to set aside half of his minimum sum from his Special Account and Ordinary Account.

We love to help you

With so many different and exciting new condo launches in the Singapore property market, it will not be easy for you to decide which new launch condo is suitable for your purchase. Allow us to help you assess your finances, plan your priorities and determine your best options. Thereafter, we will go and view the list of developments that you have shortlisted.

Make an appointment with us today by filling in the form and we will contact you very soon.

HOTLINE: +65 6100 2500

WHATSAPP: whatsapp-NewCondoLaunchOnline