Marina View site public bidding closed on Tuesday (September 21) with only one offer, since developers were apprehensive of the expensive land and development charges, as well as the volatility surrounding the Central Business District’s (CBD) office and hotel sectors.

Boulevard View (subsidiary of IOI Properties Group) offered $1,508,000,101 in their bid, barely $101 more than the $1.508 billion minimum price that activated the tender. This equates to $1,379 per sq ft per plot ratio (psf ppr), which many experts say was low.

Another white site is being developed on Central Boulevard, which it acquired in November 2016 for $2.57 billion after offering a minimum of $1.536 billion to trigger its release. The land rate was $1,689 psf ppr.

CBRE’s head of research for South-East Asia, Ms Tricia Song pointed out that the pandemic outbreak, as well as the sluggish return to CBD workplaces as many Work From Home (WFH) now, could well have lessened developers’ optimism in urban living.

It is noted that Boulevard View’s offer is below most recent Government Land Sales (GLS) residential sites offered in the CBD.

Midtown Modern’s Tan Quee Lan Street site received three bids, with a top bid of $1,535 psf ppr, says she, while One Bernam’s Tanjong Pagar site received four offers with top bid of $1,462 psf ppr, she adds.

Ms Song further stated that Tuesday’s single offer is in complete contract to that of the recent five competitive bids for city-edge or suburban residential lots.

The 5 recent plots namely Ang Mo Kio Ave 1, Lentor Central, Tengah Garden executive condo (EC), Tampines St 62 EC and Northumberland had 7 to 15 offers each with bid offers coming out higher than expected.

She blamed the Marina View site’s weak demand for unsold balance apartment units in the CBD and upcoming new condo launches.

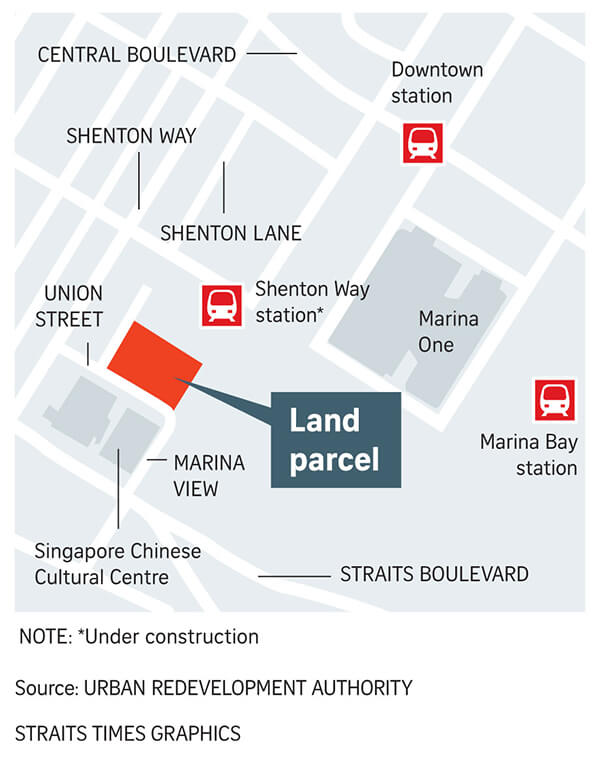

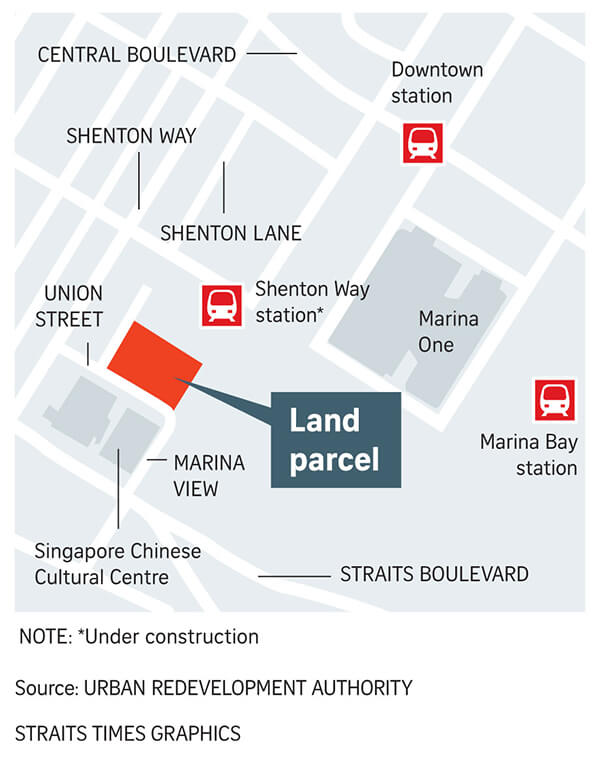

Marina View is a white site planned for a mixed-use development comprising residential, commercial, hotel and / or serviced residence. This white site is from 1st-half 2021 GLS reserve list. This site can potentially build 905 residential units with 2,000 square metres in gross floor area (GFA) of commercial space and yielding 540 hotel rooms.

High development costs could have affected the result of the tender as this represent great risks to a developer.

Head of research for Singapore at Cushman & Wakefield, Mr Wong Xian Yang said that although the world slowly opening up, the uncertainty over construction manpower short supply and global travel contributed to the lacklustre participation from other developers.

Head of transaction advisory services, hotels and hospitality at JLL Asia-Pacific, Mr Calvin Li said pointed out that participation from other bidders are low as development costs to build upmarket hotel is high.

Nicholas Mak from ERA’s head of research and consultancy highlights that the longer timeframe for development sends alarm signals that there will higher risks for developers to undertake. Furthermore, the possible bankruptcy from

Chinese housing leader Evergrande Group puts off developers from big construction projects.

Excerpt from 9 Sep 2021 Straits Times:

BEIJING – Chinese real estate private conglomerate, Evergrande, is on the verge of bankruptcy after years of tremendous growth and an acquisition binge.

In this year’s financial crisis, the company’s Hong Kong stocks have crashed due to mounting debts. If the group were to declare bankruptcy – which employs 200,000 individuals and indirectly generates 3.8 million jobs in China – the effects would be felt not just in China but around the globe as well.

Source: https://www.straitstimes.com/business/property/marina-view-gls-site-gets-just-one-bid-of-101-above-1508b-minimum-price-from-ioi

Source: https://www.straitstimes.com/business/property/explainer-evergrande-chinas-fragile-housing-giant

Head of transaction advisory services, hotels and hospitality at JLL Asia-Pacific, Mr Calvin Li said pointed out that participation from other bidders are low as development costs to build upmarket hotel is high.

Nicholas Mak from ERA’s head of research and consultancy highlights that the longer timeframe for development sends alarm signals that there will higher risks for developers to undertake. Furthermore, the possible bankruptcy from Chinese housing leader Evergrande Group puts off developers from big construction projects.

Head of transaction advisory services, hotels and hospitality at JLL Asia-Pacific, Mr Calvin Li said pointed out that participation from other bidders are low as development costs to build upmarket hotel is high.

Nicholas Mak from ERA’s head of research and consultancy highlights that the longer timeframe for development sends alarm signals that there will higher risks for developers to undertake. Furthermore, the possible bankruptcy from Chinese housing leader Evergrande Group puts off developers from big construction projects.