ABSD Doubles For Foreigners To 60%

Last Updated: Apr 30, 2023

ABSD Cooling Measure:

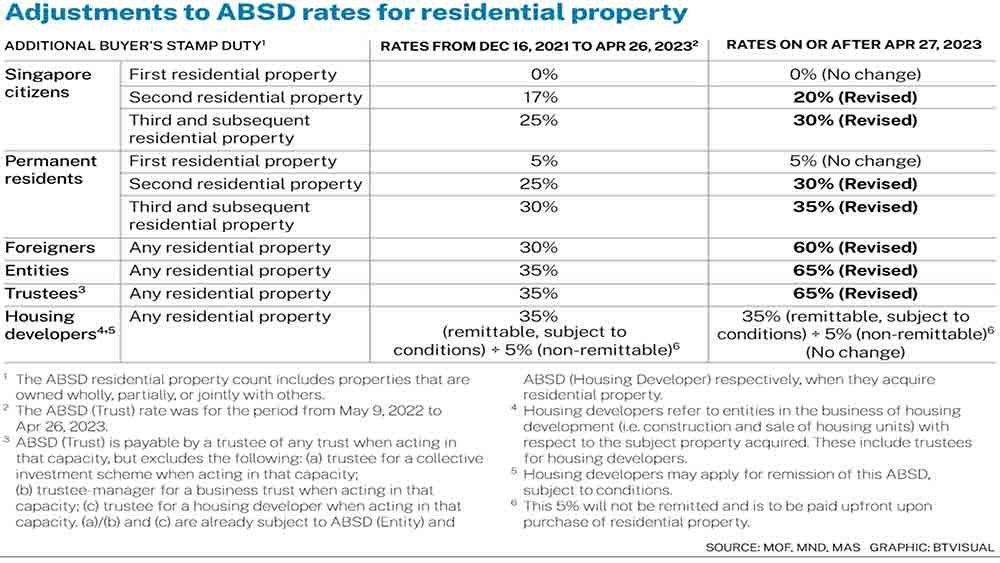

The Additional Buyer’s Stamp Duty (ABSD) latest cooling measure announced last night at about 11:50pm is effective from 27 April 2023. It is by and large targeted at foreigners (FR).

credits:mof,mnd,mas

ABSD Increases range from 3% to 30%.

- 1. 3% for Singapore Citizen (SC) – increased from 17% to 20% for 2nd residential purchase and 25% to 30% for 3rd purchase and more.

- 2. 5% for Singapore Permanent Resident (SPR) – increased from 25% to 30% for 2nd residential ownership while it is 30% to 35% for third purchase and beyond.

- 3. 30% for Foreigners (FR) – risen from 30% to 60% for any residential purchase.

The heaviest loading of the rates is on FR. There are reasons for this.

As an SC or SPR buying our 1st residential property, there is no ABSD. Hence, we should be confident to go ahead and purchase it. The government is heavily supportive of locals and SPR owning their 1st property and having a roof over their heads. With a place to stay, people will feel relieved and comfortable to sink their roots in Singapore.

As for FR, there are very strong reasons why the government has come up with such an increase in the taxes. Similar hefty increase in taxes goes for buying under Trust or buying under Company (Entity). This is to say that an individual sets up a trust or company to buy properties. As for developers, there is no change in the tax rate.

And of course for an SC who wishes to buy a 2nd property, it means you are pretty well off so it is indirectly a wealth tax on you.

In a way, property stamp duty is likened to the certificate of entitlement (COE) for cars. Bigger cubic capacity (cc) cars have to pay higher COE.

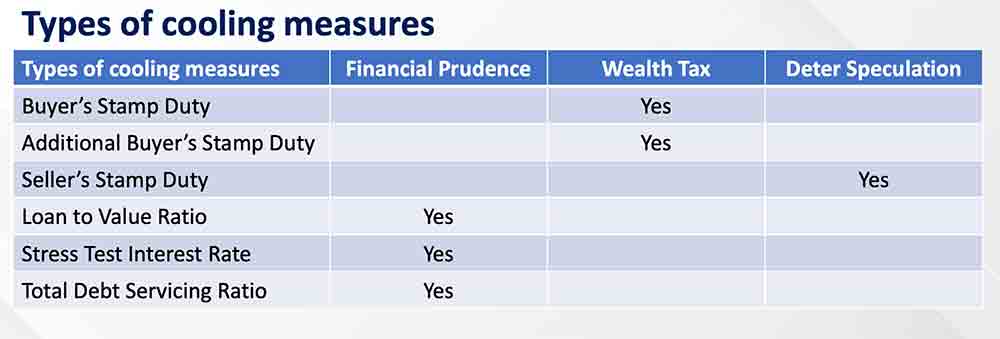

Cooling Measures can be categorised into 3 types:

27th April 2023 cooling measure is seen as a wealth tax. Everyone knows that property increase in value through time, this is why we believe in investing in property. If you have more money to invest in property, the government thinks it fair that you have to pay more taxes since you can afford to own a 2nd property as an investment asset.

Financial prudence is a key phrase in our government’s policy. One of the cooling measures in 2021 saw the reduction in the Loan To Value (LTV) from 80% to 75% and the tightening of the Total Debt Servicing Ratio (TDSR) threshold from 60% to 55%. This creates a very good 25% buffer for all home owners. If there are any changes to the market, they have this buffer to protect themselves.

ABSD Cooling Measure: Why Does The Government Come Up With This?

credits:ura/huttons

A. Low Supply & Pent-Up Demand: Leads To Higher PPI

This year, the economy is expecting 0.5% to 2.5% growth, but the 1st Q growth wasn’t very encouraging. The economic fundamentals and the property prices went out of sync in the 1st Q of 2023. Property prices went up by 3.2% vs last Q’s 0.4% increase.

In the past 2 years, the increase in non-landed Property Price Index (PPI) was almost a double digit year-on-year. One of the years was slightly more than 10% while last year was 8.6%. With the PPI for 1st Q at 3.2%, the govt saw the need to correct the ever-increasing prices lest the PPI see the days of 8%-10% again.

During the covid years of 2020 to 2022, there was pent-up demand. Supply on the other hand dropped as government land sale was tightened. This pent-up demand mopped up a good amount of the supply and pushed prices up all the way till 1st Q 2023.

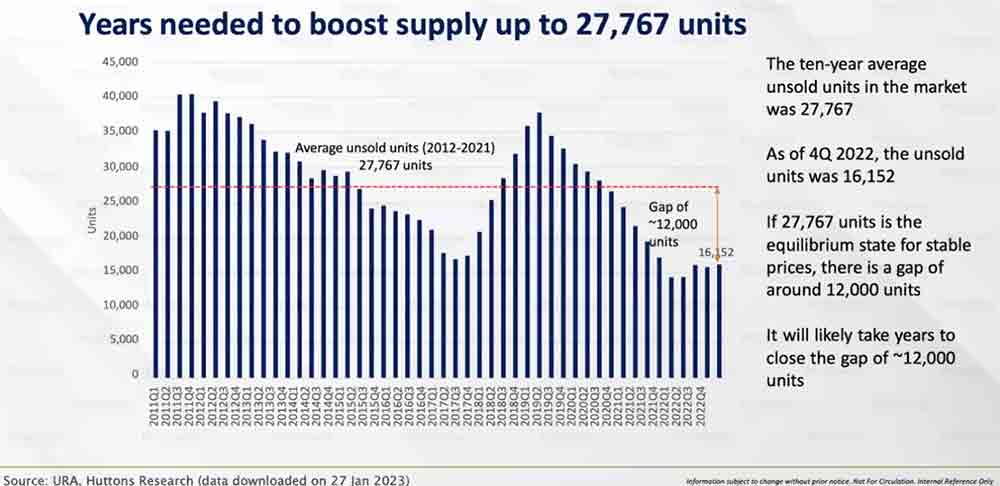

In fact right now, supply of unsold stock remains very low even though we have more launches in 2023. The supply for these upcoming new condo launches have already been factored into the 16,000 (more will be mentioned on this figure later) unsold stocks in the market. It will surely take time for supply to catch up. With this new ABSD cooling measure, hopefully it helps to buy more time for supply to slowly build up so as to allow things to go back to a more stable state for everybody.

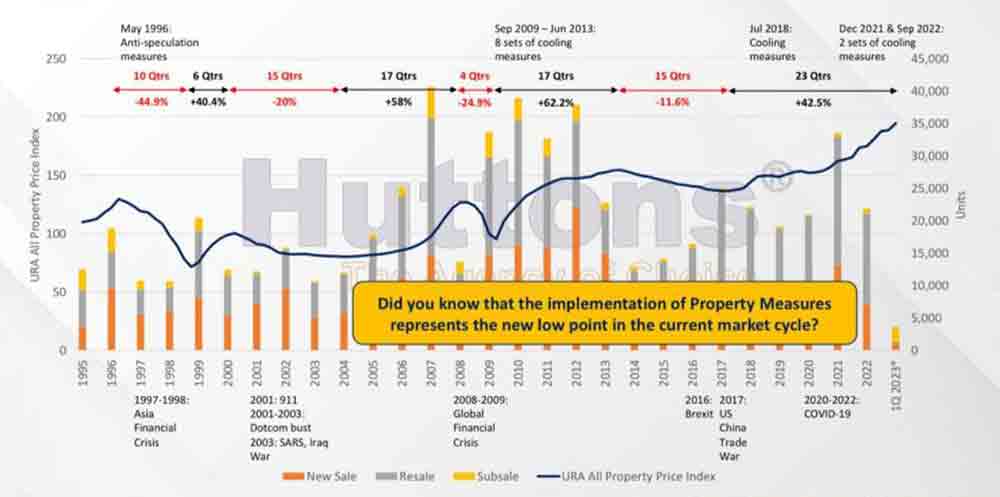

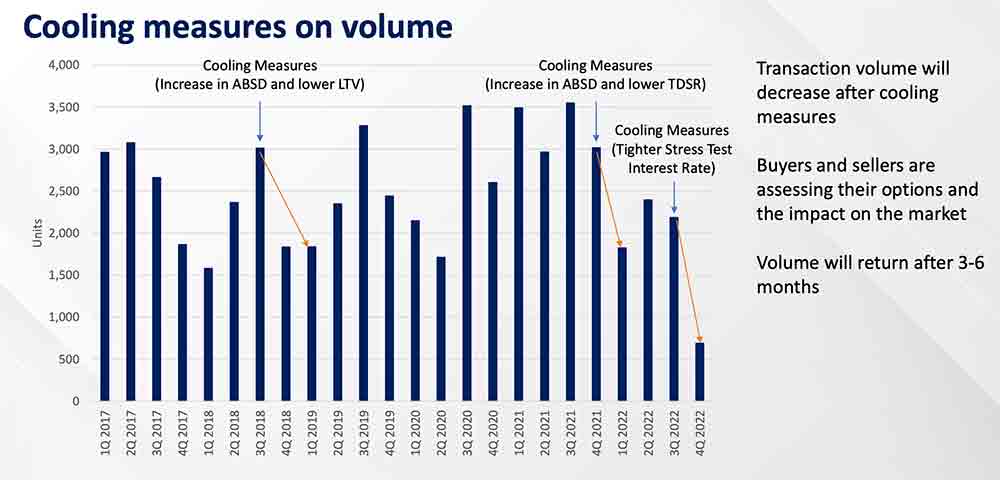

From the graph above, we can see that in order for the government to curb rising prices and to stabilise the hot market, various cooling measures have been introduced through the years. One thing to note is that the implementation of the property measure is the new low point in the current market cycle.

B. Influx of foreigners to Singapore:

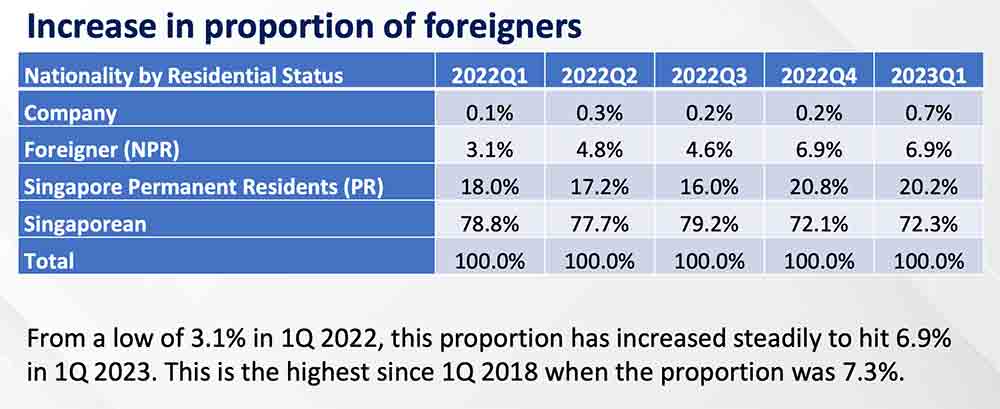

We see a spike in the proportion of FR coming to Singapore.

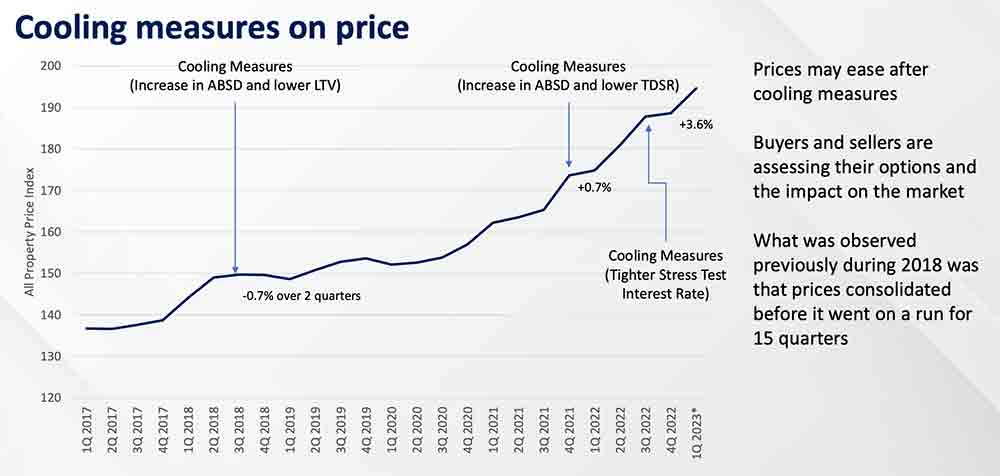

In Q1 2022, the proportion of FR coming into Singapore was 3.1%. The numbers eventually creeped up to 6.9% in Q1 2023. This is the highest since 2018 when it was 7.3%. It stayed about 6%+. Thus the govt came up with cooling measures in 3rd Q 2018 in an attempt to cool the red hot market. Well, sales volume did dip for about 2 Q before climbing back up for the next 23 Q. This led the Property Price Index to a runaway increase of 42.9%.

For the past 2 years as we had covid, the FR numbers were pretty healthy. But it has gone up a lot more as soon as the covid measures had been lifted. Everyone knows Singapore managed the covid very well so the Chinese are back once the border opened. So Singapore has become a beacon for FR who wants a safe haven. But by and large, the market is still supported by locals. The majority of our OCR and RCR launches are bought by ~80% locals and ~10% SPR. Only for the luxe market do we see a higher proportion of FR buying there. For example, the recent buying sprees at Klimt At Cairnhill. Hence, this ABSD increase which is targeting more on the FR will not affect the majority of the locals and SPR here.

From cheques collected for the upcoming launch of Blossoms By The Park by EL Development targeting to launch for sale on 29 April 2023, expressions of interest submitted indicates that over 90% of the potential buyers are locals and SPR. Hence, we can say that this ABSD cooling measure is meant to prevent the FR from spiking our PPI.

i. The Opening Of Borders In Singapore And China:

Singapore border opens. We take the c19 as a normal flu. Everyone can actually come to Singapore. So the tourist numbers have gone up. In March 2023 alone, we set a new high in terms of visitorship from international tourists. The number of tourists who flocked to our city state is a whopping million!

China relaxed their border in Jan 2023 and allowing everyone to go in and out freely without restrictions. Chinese companies are coming to Singapore to set up Headquarters. Once they are here, they have to rent or buy in Singapore. It does seem like wherever the Chinese goes, the numbers will increase quite exponentially.

ii. Increasing Numbers Of North Asia People To Singapore:

Quite a number of North Asia countries have set up offices in Singapore too. Taiwan is one of them. The Ultra High Net Worth (UNHW) Taiwanese has set up family offices in Singapore already. It is quite natural for the super rich to move their capital around because they wouldn’t want to wake up some day and find that their wealth is being detained and restricted. When they shift their capital around, it is for them to preserve and grow their wealth to another level.

Not too long ago, a Taiwanese conglomerate bought an entire building at Draycott, Singapore.

iii. US Citizens:

Another group that is gaining traction in Singapore property purchases is the US Citizens. They are not the Caucasians or real Americans. These are the Chinese immigrants from China, Taiwan and even Korea. They have the privilege to buy Singapore properties like a local Singaporean as USA is under the Free Trade Agreement with Singapore. The citizen will not be subjected to any ABSD when they buy their first property in Singapore. These are predominantly Asians using US passports.

As there has been a spike in rentals in the past year, many of the US citizens prefer to buy than to rent as they can use their rental monies to pay for their mortgage instead. This has also formed a big chunk of buyers.

C. War and Tension In other countries:

Of course there is also the tension build-up in the foreigners’ own countries. This is yet another strong reason for them to park their monies in Singapore properties.

How is the cooling measure going to affect us:

A. ABSD Cooling Measures On Volume: Don’t Wait To Buy Properties

We are not new to the cooling measures anymore. We go all the way back to 1996, the start of the measures. Statistics show that it has been pretty consistent to expect a slow down in sales following an immediate measure as people need time to absorb the news.

Based on the past cooling measures, there are a few knee jerk reactions. Volume will be affected because buyers want to mull over the situation. It’s not surprising that any cooling measures will make people take a step back to assess the matter. Once they are ready, they will go ahead and buy.

However, do note that SC and SPR’s 1st property are not affected, so they will still go ahead and make their purchase. This is something everyone should realise. The impact is not overly heavy on SC and SPR.

Out Of All These Measures, The Government Relaxed One:

4 years Seller’s Stamp Duty (SSD) has been reduced from 4 to 3 years. If an owner sells his property within his first/second/third year of purchase, SSD to be paid by him is 12%/8%/4% respectively. So out of so many measures, only one was relaxed in recent years. It goes to show that the cooling measures aren’t going to be relaxed anytime soon. And every time prices go up, another cooling measure will be introduced to tame the prices and make them more sustainable.

The last time when the SSD was relaxed, a spike in volume resulted in prices going up. Hence, don’t try to time the market, because you may be trying to catch your own tail and forever missing out on buying a property.

B. ABSD Cooling Measures On Prices:

Im the graph above, there was one price adjustment which took place in 2018. The prices eased for merely 0.7% over 2 Q. After that, it was upward movement all the way. In 2018, what happened was some consolidation or correction of the market but only for a short 2 quarters. After that, prices increased for the next 15 quarters.

In summary, trends do not lie. Similarly with this April 2023 cooling measure announcement, prices will consolidate. But it will not stay there because demand is still there as houses are still relevant, people still need to buy them.

Current Unsold Stocks At A Dangerously Low Level of 16,152 Units:

The average unsold stock inventory tracked on a ten-year cycle is 27,767 units. However, as of 4th Q 2022, the unsold stock was 16,152. This shows a grossly under supply state of approximately 12,000 units from the equilibrium level of 27,767 units. It will take years to replenish this stock. Real estate replenishment is not a next-day ready item, it takes time to plan and construct.

What Will Happen To The Rest Of The Market:

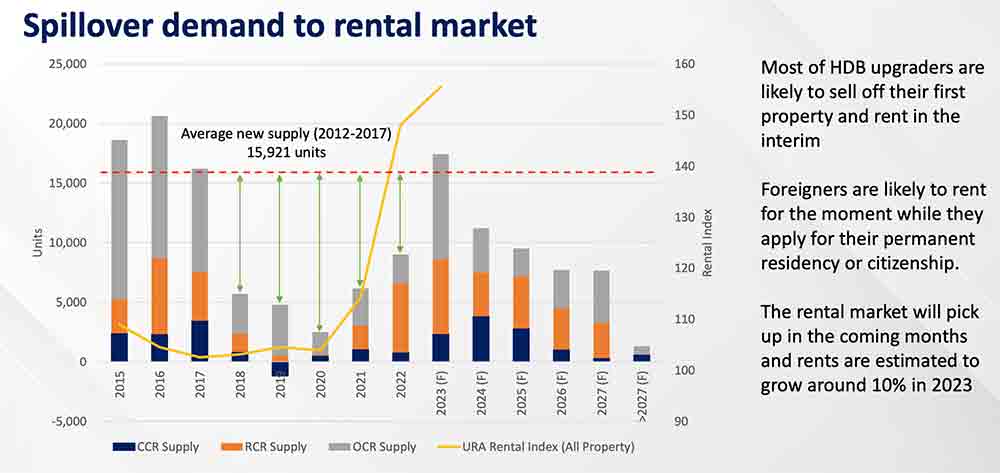

Rents will rise for sure with this ABSD cooling measure. It will push demand to the rental market. Foreigners who are sent to Singapore to work want to buy a home but if it is too expensive to buy now, they will need to rent. A 4 bedroom in Orchard leases at a high of about $20,000 to $40,000 per month.

The foreigners will need to alter the way they behave with this 60% ABSD rate:

- 1. Some of them take up an option on the unit they are renting. Once they get their PR status or citizenship, they will buy.

- 2. Some choose to rent for longer periods while they apply for their PR. And those who are already SPR, they need to hurry up to become a Singapore citizen.

At the same time, another group of buyers belonging to the HDB upgraders category will sell their HDB and rent in the interim while waiting for their new private homes to be completed. They alter their behaviour to qualify themselves as 1st timers to buy their 1st residential home. Meantime, while they rent, they are contributing to the demand in the rental market.

In short, we should see an increase in rental in the coming months. This cooling measure surely will reinforce the rents.

Any enquiries, please call our hotline: +65 61002500 | Return to HOME

We love to help you

With so many different and exciting new condo launches in the Singapore property market, it will not be easy for you to decide which new launch condo is suitable for your purchase. Allow us to help you assess your finances, plan your priorities and determine your best options. Thereafter, we will go and view the list of developments that you have shortlisted.

Make an appointment with us today by filling in the form and we will contact you very soon.

HOTLINE: +65 6100 2500

WHATSAPP: whatsapp-NewCondoLaunchOnline