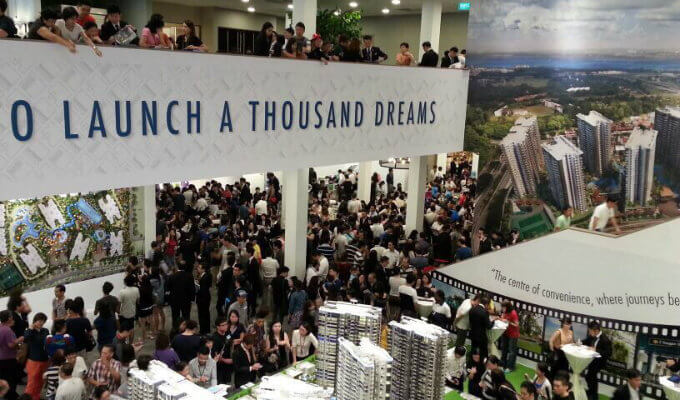

Is It The Right Time To Enter The Singapore Property Market?

Last Updated: Aug 21, 2015

Is It The Right Time To Enter The Singapore Property Market?

Property prices are softening after 5 years of increase. This is due to the Singapore government’s intervention by implementing cooling measures to curb the high in demand red-hot Singapore property market. The market peaked in 2013 as purchasers were attracted to the low borrowing interest rates and the demand from foreign property investors. The government stepped in and introduced several rounds of cooling measures. To have a better understanding of the current property market and its direction, contact New Condo Launch | Condo Singapore.

Various Cooling Measures:

Borrowers were toughest hit by the Total Debt Servicing Ratio (TDSR) measure which limits mortgage repayments to 60% of their gross monthly income. Several other curbing measures include the Additional Buyer’s Stamp Duty (ABSD) which places extra burden on house purchases made especially by foreign buyers; and there is also the Seller’s Stamp Duty (SSD) which taxes property sales if the house is sold within the first 4 years of the property purchase. Sales levy for the 1st year is 16%, 2nd year is 12%, 3rd year is 8% and the 4th year is 4%. When the house is sold in the 5th year after the property purchase, there will not be anymore sales levy charged.

The measures cooled the market down in 2014 by a 4% drop in Singapore house prices, a first since 2008.

Effects of Increase In Supply Of New Homes In 2015/2016:

Coupled with the realization that twenty thousand new houses will enter the property market in year 2015 and another same number in year 2016, landlords of rental units will face a rise in vacancy rates and slips in rental yield as foreigners arrival slows. My advice is that landlord should not be too choosy and should rent out their units as soon as possible to prevent the opportunity cost of leaving their units empty. The very least is to be able to collect some rent to help with the monthly mortgage loan repayments.

On the other hand, for the choosy landlords who prefer to wait out for want of higher rentals, they may not have the holding power to do so. This may lead to more mortgagee sales as these landlords do not have rentals to service their mortgage loan repayments.

Actually, the increase in the supply of houses is only a temporary phenomenon. As the Singapore government’s intention is to finally boost the population to 6.9m by year 2030, it is only right to set up the infrastructure (eg: build houses and roads) first before admitting an influx of foreigners albeit higher level executives and professionals.

Low Number of Mortgage Loan Defaulters:

Having said all the above, the fact is that the Monetary Authority of Singapore (MAS) December 2014 figures reported only a minor group of home owners in Singapore (only about 1%) have mortgage repayment difficulties. This says a great deal about the positive financial stability of Singapore property buyers. The mortgage loan defaulters form only a small number consisting of the high-end luxury housing developments such as The Sail at Marina Bay, Marina Bay Residences, Reflections @ Keppel Bay and The Turquoise in Sentosa.

Right Time To Enter Property Market:

1. For those buyers who are sitting on the fence and waiting for huge slides in home prices, my advice is that this is probably the right time to enter the buyers’ market when the property market is soft. Home prices are superbly attractive in this current conservative market.

2. Even developers are bidding cautiously so that savings can be passed on to buyers. One development in point is the High Park Residences whereby the bid prices for a twin plot tender in late 2014 were entered conservatively. In the end, the per square foot per plot ratio for the 2 land parcels entered by CEL Development and Unique Residences resulted in the lowest bid prices as compared to 2 nearby projects, Riverbank and Rivertrees Residences.

3. We should always remember that we cannot really time the market to buy property but rather, we should buy property and wait; unless of course if you have a magic crystal ball to tell you that the timing is right! This is because as we wait, our loan tenure decreases by the number of years we delay in buying a home. This would in turn lead to higher mortgage loan repayment amounts.

4. Also, if we do not take advantage of the relatively lower mortgage loan interest now as compared to foreign countries’ higher interest rates, we are essentially not taking the opportunity to leverage on this lower cost of borrowing money.

5. When one purchases a new condo launch apartment now, the estimated time of completion (TOP) is likely in the year 2018 to 2020. According to the MND chart illustrated above, 2018 will see a considerable reduction in the number of completed private residential apartments. This offers a positive pointer for home owners or home investors as supply will be low in that year and possibly in the ensuing year or two.

So the advice is that if one has the budget and has found the ideal location, it is the RIGHT TIME to buy the property. Remember this mantra: “Buy property and wait to reap the benefits; not wait to buy property!”

Some new launch condo developments to look out for that are moving at a consistently good pace are Botanique @ Bartley, Lakeville @ Lakeside and High Park Residences, just to name a few.

We love to help you

With so many different and exciting new condo launches in the Singapore property market, it will not be easy for you to decide which new launch condo is suitable for your purchase. Allow us to help you assess your finances, plan your priorities and determine your best options. Thereafter, we will go and view the list of developments that you have shortlisted.

Make an appointment with us today by filling in the form and we will contact you very soon.

HOTLINE: +65 6100 2500

WHATSAPP: whatsapp-NewCondoLaunchOnline