Living Trust ABSD Imposed On Residential Property Transfer

Last Updated: May 17, 2022

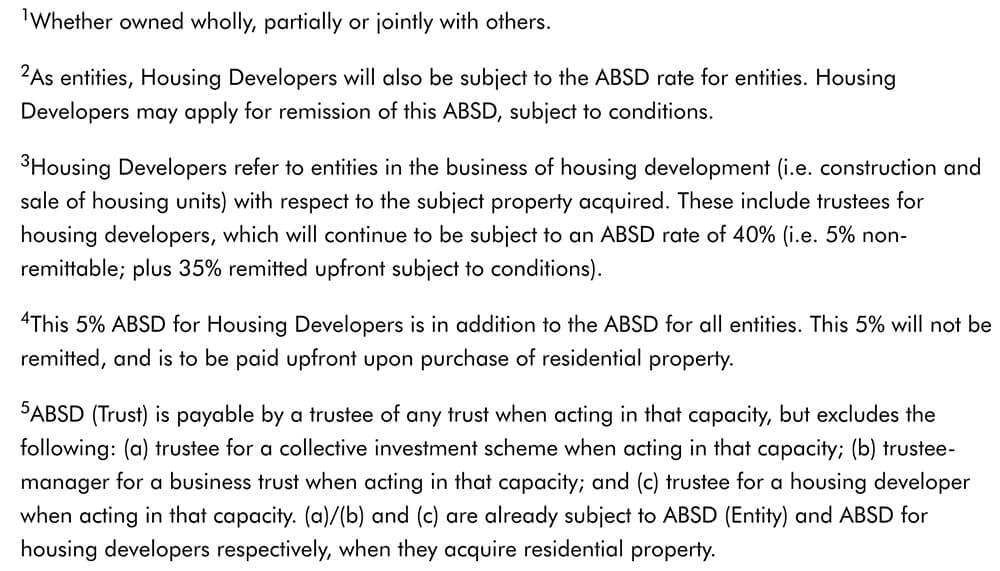

On or after 9 May 2022, a 35% additional buyer’s stamp duty (ABSD) will be imposed on all transfers of residential property into a living trust. This is regardless of whether there is an identifiable beneficial owner, Living Trust ABSD will still be applicable.

What Is A Living Trust?

When a living trust is created during a person’s lifetime, it is referred to as a living trust.

credit:creation

Reason For Implementing The Living Trust ABSD?:

This new measure comes barely 5 months after the last Singapore property market cooling measure was announced on 16 Dec 2021. The incurrence of ABSD on living trust comes in the wake of some wealthy buyers trying to get around paying ABSD by the transfer of residential properties into living trusts. Hence, only Buyer’s Stamp Duty (BSD) is paid.

The purchases have contributed in part to the rising demand for limited new condo stocks in the market. This thus drives property prices up. At the same time, the Government Land Sales (GLS) programme is kept under tight rein to moderate the release of new lands. The 2022 GLS programme is at an all-time low. Hence, property buyers rush to mop up whatever existing balance of new condo stocks there are in the current market. This further fueled the increase in property prices as supply drops further.

At the same time, it is noted that an increasing number of wealthy buyers try to get around paying ABSD by the transfer of residential properties into living trusts. Hence, only Buyer’s Stamp Duty (BSD) is paid.

Different Buyer Profiles Determine The ABSD Rate:

Before the new measure on 9th May 2022, BSD was imposed on the transfer of residential properties into living trusts. There may even be ABSD, depending on the characteristics of the beneficial owner(s) of the residential property. ABSD is imposed on owners who purchase 2 and more residential properties.

If the beneficial owner is a Singapore citizen and does not have any residential property in his name, no ABSD will be incurred on his 1st property. On the other hand, if this beneficial owner currently owns one residential property, and becomes the beneficiary of another residential property, a 17% ABSD will be imposed on the 2nd property. If the residential property that this beneficial owner is placed in trust of is his 3rd property, a 25% ABSD imposition is mandatory. Different ABSD rates will be imposed on different profiles of buyers depending on their nationality and the number of residential property ownership. Check this out in the latest ABSD table below.

credit:mof

Before New Policy Change: ABSD Exemption For No Identifiable Beneficial Owner(s):

In addition, a living trust that is structured so the residential property cannot be assigned a beneficial owner at the time when the residential property is transferred to the trust is exempt from ABSD.

New Policy Implemention On Living Trust:

Following its policy reviews, the Singapore authority has introduced a 35% upfront payable ABSD on Living Trust to close the loophole. As a result, ABSD will be payable even if the residential property is transferred to a trust without an identifiable beneficial owner. ABSD should apply to any transfer of residential properties into a living trust, regardless of whether beneficial owners of those properties can be identified. ABSD should work toward ensuring that the Singapore housing market is stable and sustainable.

It is necessary to pay the ABSD (Trust) in advance when the residential property is transferred into any living trust. The Inland Revenue Authority of Singapore (IRAS) can refund ABSD (Trust) to a trustee under the following conditions:

A refund amount will be calculated by deducting the ABSD (Trust) rate of 35% from the ABSD rate applicable to the profile of the beneficial owner with the highest ABSD rate. For example, if a transfer of the residential property to the living trust of a beneficial owner makes this his 2nd property, the refund of the ABSD will be 35% – 17% (ABSD payable of 2nd residential property) = 18%. If you wish to request a refund, you must make the request to IRAS within six months of the instrument’s execution.

FREQUENTLY ASKED QUESTIONS – FAQ

What is a Living Trust?

A living trust is a legal document, or trust, created during the lifetime of an individual (the trustor or grantor) with a designated trustee tasked with managing the assets of that individual for the beneficiary’s benefit.What is the ABSD rate imposed on Living Trust?

The ABSD rate imposed on the transfer of residential properties into living trust is 35% and is to be paid upfront.Can living trust ABSD be refunded?

The living trust ABSD can only be refunded when the residential property’s beneficial owners are identifiable, and all beneficial owners have vested in the property at the time of transfer into the trust. In addition, to the extent the trust provides for it, the beneficial ownership cannot be varied or rescinded nor could it be subjected to any conditions thereafter.How much of the living trust ABSD be refunded?

A refund amount will be calculated by deducting the ABSD (Trust) rate of 35% from the ABSD rate applicable to the profile of the beneficial owner with the highest ABSD rate. The application for refund must be within 6 months of the execution of the instrument.Contact Us

Any enquiries, please call our hotline: +65 61002500 | Return to HOME

source:https://www.mof.gov.sg/news-publications/press-releases/additional-buyer-s-stamp-duty-(absd)-for-residential-properties-transferred-into-a-living-trust

We love to help you

With so many different and exciting new condo launches in the Singapore property market, it will not be easy for you to decide which new launch condo is suitable for your purchase. Allow us to help you assess your finances, plan your priorities and determine your best options. Thereafter, we will go and view the list of developments that you have shortlisted.

Make an appointment with us today by filling in the form and we will contact you very soon.

HOTLINE: +65 6100 2500

WHATSAPP: whatsapp-NewCondoLaunchOnline