Retirement Sum Scheme And CPF LIFE Scheme

Last Updated: Sep 02, 2016

Retirement Sum Scheme And CPF LIFE Scheme

What is Retirement Sum?

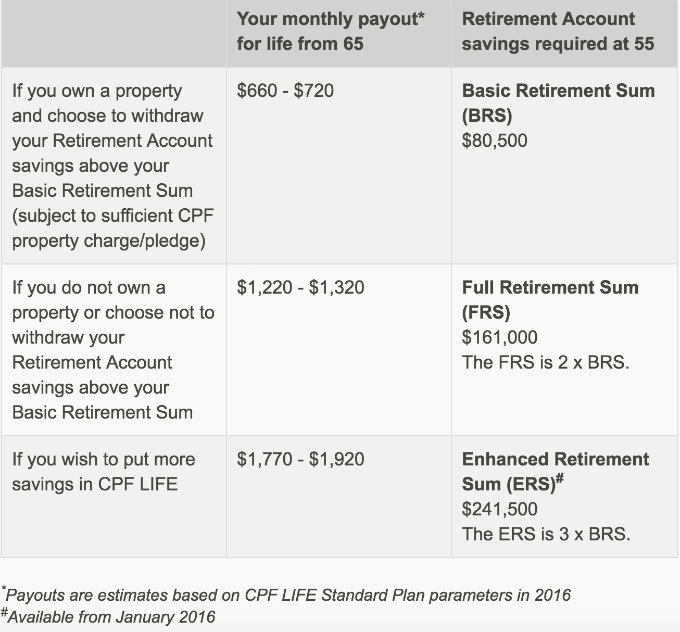

Retirement Sum is the sum you set aside in your Retirement Account in order to get monthly payout from your eligible payout age, which is at 65 years old currently.

So, if you now own a Singapore property and have utilised your CPF to purchase this property, you need to set aside $80,500 in your Special Account and Ordinary Account for your Retirement Sum before you can utilise the balance in your Ordinary Account to purchase your next property.

Do note that the Basic Retirement Sum (BRS) which stands at $80,500 for those who reach age 55

years in 2016 this year will be increased by about 3% every year thereafter to cater for inflation and higher standards of living. See the following table to determine which year you will reach 55 years old and the respective BRS or FRS you need to set aside as your Retirement Sum.

| Age & Year | Basic Retirement Sum (BRS) | Full Retirement Sum (FRS) | Enhanced Retirement Sum (ERS) |

|---|---|---|---|

| Age 55 in 2016 | $80,500 | $161,000 | $241,500 |

| Age 55 in 2017 | $83,000 | $166,000 | $249,000 |

| Age 55 in 2018 | $85,500 | $171,000 | $256,500 |

| Age 55 in 2019 | $88,000 | $176,000 | $264,000 |

| Age 55 in 2020 | $90,500 | $181,000 | $271,500 |

(Credits: CPF)

Why set aside Retirement Sum?

For CPF members who have reached 55 years old, setting aside the Retirement Sum will ensure them of regular monthly income from their payout eligibility age (currently at age 65 years old) for about 20 years. This is to support a basic standard of living.

How your Retirement Sum is set aside?

When you reach age 55 years, money from your Special Account and Ordinary Account will be transferred to your Retirement Account.

- If you are on the Retirement Sum Scheme, you will get a regular monthly payout for about 20 years starting from your payout eligibility age (currently is at 65 years old).

- If you choose to use your Retirement Sum to join the CPF LIFE Scheme, you will get a lifetime monthly payout.

After you set aside money for the BRS or FRS, you have a choice to either withdraw the balance of the money or leave the remainder of the excess money in CPF to earn attractive interest rates.

CPF LIFE

What is CPF LIFE?

An additional attractive feature is added to better manage long life risks and that is the CPF LIFE Scheme, which was introduced in 2009. Nowadays, people tend to live longer as medicine is more advanced and they are more knowledgeable on how to keep fit and eat well to live longer. This scheme will ensure a CPF member draws a monthly income for as long as they live.

Who can join CPF LIFE?

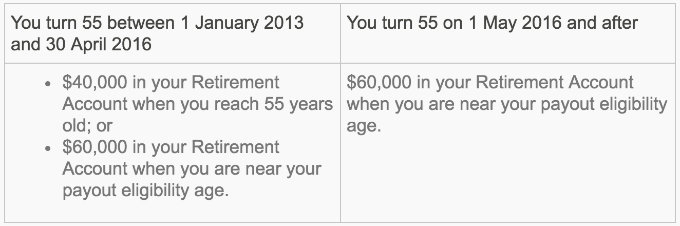

You have to join CPF LIFE Scheme if you are a Singapore Citizen (SC) or Singapore Permanent Resident (SPR) born in 1958 or after and have a minimum sum of :

- $40k in Retirement A/C when they attain age 55 years old; or

- $60k in Retirement A/C when they attain age 65 years old

For those who have not been placed on the CPF LIFE because they were born before 1958 or have not attained the stated Retirement Account amount, they can apply to join into this CPF LIFE plan scheme between their payout eligibility age and before they reach 80 years of age.

What types of CPF LIFE plans are available?

There are 2 types of CPF LIFE plans. You can either choose the

- LIFE Standard Plan;

- LIFE Basic Plan

The LIFE Standard Plan gives more monthly payouts and less is paid out to beneficiaries; while the LIFE Basic Plan pays out higher bequest but lower monthly payouts.

For more information, check out the CPF Schemes from CPF Board website.

Some upcoming new Singapore condo launches for your selection:

√ Forest Woods

√ The Clement Canopy

√ Alps Residences – information coming out soon. Stayed tune by visiting our www.NewCondoLaunchOnline.com Home page

We love to help you

With so many different and exciting new condo launches in the Singapore property market, it will not be easy for you to decide which new launch condo is suitable for your purchase. Allow us to help you assess your finances, plan your priorities and determine your best options. Thereafter, we will go and view the list of developments that you have shortlisted.

Make an appointment with us today by filling in the form and we will contact you very soon.

HOTLINE: +65 6100 2500

WHATSAPP: whatsapp-NewCondoLaunchOnline